Life Insurance Corporation of India (LIC) is a cornerstone of financial security for millions of individuals and families in India. Established in 1956, LIC has grown to become the largest insurance provider in the country, offering a wide range of life insurance policies designed to meet diverse needs. These policies not only provide a safety net for families in the event of the policyholder’s death but also offer various benefits such as savings, investment, and retirement planning.

One of the critical aspects of LIC policies that policyholders need to understand is the concept of surrender value. Surrendering a policy involves terminating it before its maturity, which might be necessary due to financial emergencies or changes in personal circumstances. When a policy is surrendered, the policyholder receives the surrender value, which is a portion of the total premiums paid.

This guide aims to provide a comprehensive understanding of LIC’s surrender value, especially focusing on how to calculate the surrender value after five years. We will delve into the factors affecting the surrender value, the calculation method, and the implications of surrendering a policy. By the end of this guide, you will have a clear understanding of how to use a surrender value calculator effectively and make informed decisions about your LIC policy.

Introduction to LIC Policies and Surrender Value

Understanding LIC Policies

LIC offers a variety of life insurance policies, including endowment plans, term insurance, money-back plans, and whole life policies. Each type of policy serves different financial objectives, such as providing death benefits, encouraging savings, or supporting long-term investment goals. Understanding the type of policy you hold is crucial because the surrender value calculation and benefits differ across policy types.

What is Surrender Value?

The surrender value is the amount a policyholder receives if they decide to terminate their policy before its maturity date. It is calculated based on the premiums paid and the duration for which the policy has been active. The surrender value provides a way for policyholders to recover a portion of their investment in situations where continuing the policy is no longer feasible or desirable.

Why Do Policyholders Surrender Policies?

Policyholders might choose to surrender their policies for several reasons, including financial emergencies, better investment opportunities, dissatisfaction with the policy’s performance, or changes in personal circumstances such as job loss, medical emergencies, or significant life events. While surrendering a policy can provide immediate financial relief, it also means forfeiting future benefits that the policy might offer.

Factors Influencing Surrender Value

Premium Payment Term

The premium payment term (PPT) is the period during which the policyholder must pay premiums to keep the policy active. Policies with longer PPTs typically accumulate higher surrender values because more premiums have been paid into the policy.

Policy Tenure

The policy tenure is the total duration for which the policy provides coverage. The surrender value generally increases with the tenure because more time allows for the accumulation of bonuses and additions.

Policy Type

Different types of LIC policies have varying rules for calculating surrender value. For example, traditional endowment plans and money-back policies might have different formulas and surrender benefits compared to term insurance or whole life policies.

Bonuses and Additions

Many LIC policies participate in the corporation’s profits and earn bonuses over time. These bonuses contribute to the policy’s surrender value. The type and amount of bonus, whether reversionary or terminal, can significantly impact the surrender value.

The Guaranteed Surrender Value

The guaranteed surrender value is a minimum amount guaranteed by LIC that the policyholder will receive upon surrendering the policy. It is typically a percentage of the premiums paid, excluding any additional benefits or bonuses.

The Special Surrender Value

The special surrender value is usually higher than the guaranteed surrender value and takes into account factors such as the accrued bonuses and the remaining policy term. It is calculated based on the policy’s accumulated benefits and the surrender value factor specified in the policy terms.

Detailed Guide to Calculating Surrender Value After 5 Years

General Formula for Surrender Value

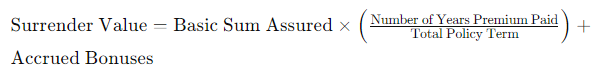

The general formula for calculating surrender value is:

However, this formula can vary depending on the policy type and terms.

Step-by-Step Calculation

Step 1: Understanding the Basic Sum Assured

The basic sum assured is the guaranteed amount that LIC promises to pay on maturity or death, whichever occurs earlier. It forms the base for calculating the surrender value and varies depending on the policy type and coverage amount chosen by the policyholder.

Step 2: Identifying the Premiums Paid

Identify the total premiums paid until the time of surrender. This includes all regular premium payments made over the policy duration. For a surrender after 5 years, sum up all the premiums paid during this period.

Step 3: Factoring in Bonuses

Bonuses are additional amounts that LIC declares periodically and adds to the policy. These can be simple reversionary bonuses, which are a percentage of the sum assured, or other types like terminal bonuses. Calculate the total accrued bonuses up to the time of surrender.

Step 4: Calculating the Guaranteed Surrender Value

The guaranteed surrender value is calculated as a percentage of the total premiums paid. For most LIC policies, it is a fixed percentage (e.g., 30% after three years) but can vary based on policy specifics.

Guaranteed Surrender Value = Total Premiums Paid × Guaranteed Surrender Value Percentage

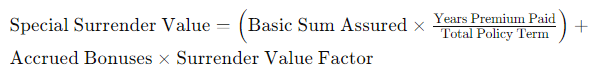

Step 5: Determining the Special Surrender Value

The special surrender value is generally higher than the guaranteed value and is calculated as:

Example Calculations

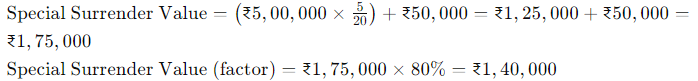

Sample Calculation 1: Traditional Endowment Policy

- Sum Assured: ₹5,00,000

- Policy Term: 20 years

- Premium Paid: ₹20,000 per annum

- Accrued Bonuses: ₹50,000 after 5 years

- Guaranteed Surrender Value Percentage: 30%

Guaranteed Surrender Value Calculation:

Total Premiums Paid=₹20,000×5=₹1,00,000

Guaranteed Surrender Value=₹1,00,000×30%=₹30,000

Special Surrender Value Calculation:

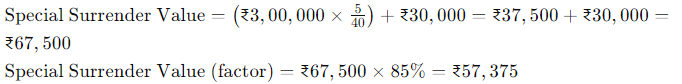

Sample Calculation 2: Whole Life Policy

- Sum Assured: ₹3,00,000

- Policy Term: Whole life

- Premium Paid: ₹10,000 per annum

- Accrued Bonuses: ₹30,000 after 5 years

- Guaranteed Surrender Value Percentage: 30%

Guaranteed Surrender Value Calculation:

Total Premiums Paid=₹10,000×5=₹50,000

Guaranteed Surrender Value=₹50,000×30%=₹15,000

Special Surrender Value Calculation:

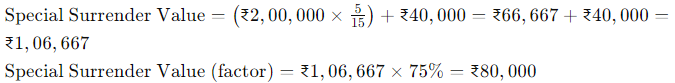

Sample Calculation 3: Money Back Policy

- Sum Assured: ₹2,00,000

- Policy Term: 15 years

- Premium Paid: ₹15,000 per annum

- Accrued Bonuses: ₹40,000 after 5 years

- Guaranteed Surrender Value Percentage: 30%

Guaranteed Surrender Value Calculation:

Total Premiums Paid=₹15,000×5=₹75,000

Guaranteed Surrender Value=₹75,000×30%=₹22,500

Special Surrender Value Calculation:

Using an LIC Surrender Value Calculator

Overview of Surrender Value Calculators

LIC surrender value calculators are online tools that simplify the process of calculating the surrender value of a policy. These calculators take into account the policy type, premium payments, policy term, and accrued bonuses to provide an estimate of the surrender value.

Features of a Good Calculator

A good LIC surrender value calculator should:

- Support various LIC policy types.

- Allow input for premiums paid, bonuses, and policy term.

- Provide accurate and up-to-date surrender value calculations.

- Offer a user-friendly interface with clear instructions.

Step-by-Step Guide to Using the Calculator

- Select Policy Type: Choose the specific LIC policy you hold from the options provided in the calculator.

- Enter Policy Details: Input the sum assured, annual premium amount, and policy term.

- Input Premiums Paid: Enter the total premiums paid up to the point of surrender.

- Add Bonuses: Include any accrued bonuses that have been declared by LIC.

- Calculate Surrender Value: Click the calculate button to get the estimated surrender value.

Interpreting the Results

The calculator will provide an estimate of both the guaranteed surrender value and the special surrender value. Use these results to make informed decisions about whether to surrender the policy or continue with it based on your financial needs.

Pros and Cons of Surrendering an LIC Policy After 5 Years

Benefits of Surrendering

- Immediate Financial Relief: Access to funds for emergencies or other immediate needs.

- Stop Future Premiums: Relief from the obligation of paying future premiums.

- Investment Reallocation: Opportunity to reallocate funds into higher-yield investments.

Drawbacks of Surrendering

- Loss of Future Benefits: Forfeiture of death benefits and maturity benefits.

- Lower Returns: Surrender value is often less than the total premiums paid.

- Tax Implications: Possible tax liabilities depending on the policy and surrender value.

Alternatives to Surrendering

- Policy Loan: Borrowing against the policy instead of surrendering it.

- Partial Surrender: If allowed, partially surrender the policy to access funds without terminating it entirely.

- Reduced Paid-Up Policy: Convert the policy into a paid-up policy with reduced benefits.

Real-life Case Studies and Examples

Case Study 1: Young Professional

A young professional, aged 30, faces a financial emergency and considers surrendering a 10-year endowment policy after 5 years to access the surrender value for immediate expenses.

Case Study 2: Retiree

A retiree with a whole life policy contemplates surrendering the policy to reallocate funds into a more secure investment option that provides regular income.

Case Study 3: Family with Dependents

A family with dependents is evaluating whether to surrender a money-back policy after 5 years to fund higher education expenses for their children.

Final Thoughts and Recommendations

Understanding the surrender value of your LIC policy is essential for making informed financial decisions. Whether you decide to surrender your policy or explore alternatives, having a clear grasp of how surrender value is calculated will empower you to make choices that align with your financial goals and needs. Always consider consulting with a financial advisor to understand the full implications of surrendering your policy and to explore all available options.

FAQs on LIC Surrender Value

What is the surrender value in LIC policies?

The surrender value is the amount paid to the policyholder if they decide to terminate the policy before its maturity date. It is based on the premiums paid and the duration for which the policy has been active.

How is the surrender value different from the maturity value?

The maturity value is the amount paid to the policyholder at the end of the policy term, including the sum assured and accrued bonuses. The surrender value is a proportion of the premiums paid plus accrued bonuses, paid if the policy is terminated early.

When can I surrender my LIC policy?

Most LIC policies can be surrendered after they have acquired a surrender value, usually after three years of premium payments. Some policies may have different conditions, so it’s important to check the policy document.

Can I surrender my policy if I have taken a loan against it?

Yes, you can surrender a policy with an outstanding loan. However, the surrender value will be adjusted by deducting the outstanding loan amount and any interest due.

Can I surrender my LIC policy online?

Yes, many LIC policies can be surrendered online through the LIC customer portal.

Is the surrender value taxable?

The surrender value may be taxable depending on the policy type and duration. Consult a tax advisor for specifics.

How long does it take to receive the surrender value?

Typically, it takes a few weeks for LIC to process the surrender request and credit the surrender value.

What is the minimum period before I can surrender my LIC policy?

Generally, LIC policies can be surrendered after a minimum of 3 years of continuous premium payment. Some policies may have specific conditions, so always refer to the policy document.

Are there penalties for surrendering a policy early?

Yes, surrendering a policy early can result in penalties, typically reflected in a lower surrender value. Early surrender might also mean forfeiting certain bonuses and benefits.

How does the type of LIC policy affect the surrender value calculation?

Different LIC policies, such as endowment, whole life, and money-back plans, have unique surrender value formulas and factors. These differences can impact the amount you receive upon surrender.

Do all LIC policies have a surrender value?

Not all LIC policies have a surrender value. Term insurance policies, for example, typically do not accumulate any surrender value because they do not have a savings or investment component.

How does the surrender value differ from the paid-up value?

The surrender value is the amount you receive if you terminate the policy early. The paid-up value is a reduced sum assured paid at maturity or on death if premiums stop but the policy is not surrendered.

Is the surrender value the same as the maturity value?

No, the surrender value is the amount received when you terminate the policy early, while the maturity value is the amount received at the end of the policy term, including bonuses and additional benefits.

What happens to the bonuses if I surrender my policy?

When you surrender your policy, you typically receive a portion of the accrued bonuses. The exact amount depends on the policy’s surrender value calculation method.

Does the surrender value include the loyalty addition?

Loyalty additions may be included in the surrender value if the policy has been in force for a significant period, typically beyond 5 years. However, it depends on the specific terms of the policy.

What is the surrender value factor?

The surrender value factor is a percentage used in calculating the special surrender value, reflecting how much of the accumulated benefits you receive upon surrendering the policy.

How is the surrender value different for single premium policies?

Single premium policies generally have a higher surrender value percentage compared to regular premium policies, reflecting the upfront lump sum payment.

How does surrendering a policy impact my overall financial plan?

Surrendering a policy can provide immediate funds but may disrupt long-term financial planning. It can also result in a lower return on investment compared to holding the policy to maturity.

Can I reinstate my LIC policy after surrendering it?

No, once a policy is surrendered, it cannot be reinstated. You would need to purchase a new policy if you wish to have life insurance coverage again.

Will surrendering my policy affect my credit score?

Surrendering an LIC policy does not impact your credit score as it is not a credit product. However, it can affect your financial stability and savings.

How does surrendering a policy affect tax benefits?

Surrendering a policy may affect tax benefits. Premiums paid in earlier years may lose their tax-exempt status, and the surrender value received might be taxable as per the prevailing tax laws. Consult a tax advisor for specifics.

Is there a difference in surrender value for NRIs (Non-Resident Indians)?

The calculation method for surrender value remains the same for NRIs. However, tax implications and repatriation rules might differ.

Can I use the surrender value for policy loans?

Policy loans are typically based on the policy’s surrender value. If you have an existing loan, the surrender value will be reduced by the outstanding loan amount and any interest due.

Can I surrender a policy with unpaid premiums?

If premiums are unpaid and the policy is within the grace period, you can surrender the policy, but the outstanding premiums may be deducted from the surrender value.

What is the difference between guaranteed and special surrender value?

The guaranteed surrender value is a minimum amount assured, often a percentage of total premiums paid. The special surrender value is typically higher, factoring in accrued bonuses and a surrender value factor based on the policy’s duration and terms.

How do I calculate the surrender value of my LIC policy?

The surrender value can be calculated using the general formula:

Surrender Value = Guaranteed Surrender Value + Accrued Bonuses × Surrender Value Factor

This varies depending on the policy type and the terms outlined in the policy document.

What is the role of bonuses in surrender value?

Bonuses are additional amounts declared by LIC based on its profitability and are added to the policy’s sum assured. These bonuses accumulate over time and contribute to the surrender value when the policy is surrendered.

What is the difference between guaranteed surrender value and special surrender value?

The guaranteed surrender value is a minimum amount, typically a percentage of the premiums paid, guaranteed by LIC. The special surrender value is usually higher and includes the guaranteed surrender value plus a portion of the accrued bonuses, adjusted by a surrender value factor.

How long does it take to receive the surrender value after requesting policy surrender?

It generally takes a few weeks for LIC to process the surrender request and transfer the surrender value to your account.

Can I use an online calculator to estimate my policy’s surrender value?

Yes, many online calculators are available to estimate the surrender value. You need to input details like policy type, sum assured, premiums paid, and accrued bonuses. These calculators provide a quick estimate but for accurate values, refer to your policy document or consult with LIC.

How accurate are online surrender value calculators?

Online calculators provide estimates based on general formulas and typical policy terms. For precise values, especially for complex policies, it’s best to consult LIC directly or refer to your policy documentation.

Is it possible to surrender my LIC policy online?

Yes, many LIC policies can be surrendered online through the LIC e-services portal. You need to log in, provide necessary policy details, and submit the surrender request online.

What are the tax implications of surrendering an LIC policy?

The surrender value received might be taxable depending on the policy type and duration. If the policy is surrendered before completion of five years, the tax benefits claimed under Section 80C may be reversed, and the surrender value might be added to your income for tax purposes. It is advisable to consult a tax advisor for detailed information.

Does surrendering a policy affect my credit score?

Surrendering an LIC policy does not directly affect your credit score. However, if you have taken a loan against the policy and fail to repay it before surrendering, it might impact your creditworthiness.

What happens if I surrender my policy and later want to reinstate it?

Once a policy is surrendered, it is terminated, and you cannot reinstate it. You would need to purchase a new policy if you want insurance coverage again.

Is there a penalty for surrendering my LIC policy?

There isn’t a penalty per se, but the surrender value is usually lower than the total premiums paid and accrued bonuses, which could be seen as a financial loss.

How does surrendering a whole life policy differ from surrendering an endowment policy?

Whole life policies provide coverage for the policyholder’s entire life and typically accumulate higher surrender values over time due to their longer duration. Endowment policies have a fixed term, and their surrender value depends on the premiums paid and bonuses accrued up to the surrender point.

Can I partially surrender my LIC policy?

Partial surrender is not generally available for most LIC policies. You must either continue paying premiums until maturity or surrender the policy completely.

What happens to the bonuses if I surrender my policy early?

Bonuses accumulated until the surrender date contribute to the surrender value. However, surrendering early means you may miss out on future bonuses and the full maturity benefits.

How does the surrender value affect insurance coverage?

Upon surrendering, the insurance coverage provided by the policy ceases. You lose the death benefit protection and any other associated benefits.

Can I reinstate a surrendered LIC policy?

Once a policy is surrendered, it cannot typically be reinstated. Some policies might allow revival under specific conditions if the surrender was processed as a lapse instead.

What should I consider before surrendering my policy?

Consider the financial implications, loss of future benefits, alternative funding options, and the impact on your long-term financial planning before deciding to surrender your policy.

What are the alternatives to surrendering my LIC policy?

Alternatives include taking a loan against the policy, opting for a reduced paid-up policy, or partially surrendering the policy if allowed.

What is a reduced paid-up policy?

A reduced paid-up policy is an option where, instead of surrendering, you stop paying premiums, and the policy continues with a reduced sum assured.

How does partial surrender work?

Partial surrender involves withdrawing a portion of the policy’s value, if allowed, while keeping the policy active with reduced benefits.

Should I surrender my LIC policy if I need money urgently?

Surrendering your policy should be a last resort. Consider other options like policy loans, partial surrenders, or external loans to avoid losing future benefits.

What happens to the bonuses if I surrender my policy?

Accrued bonuses up to the point of surrender are usually included in the special surrender value calculation. However, any future bonuses will be forfeited.

Can I surrender my policy after paying premiums for just one or two years?

Generally, LIC policies accrue surrender value only after premiums have been paid for at least 3 years. Surrendering before this period usually results in no surrender value being payable.

Is the surrender value taxable?

Yes, the surrender value may be taxable under the Income Tax Act if the policy does not meet certain conditions. It’s advisable to consult a tax professional for specific advice based on your policy and tax situation.

How does surrendering a policy affect my financial planning?

Surrendering a policy can provide immediate funds but also means losing future benefits like maturity amount and death cover. It’s essential to consider the impact on your long-term financial goals and explore alternatives like policy loans.

Can I get a loan against my LIC policy instead of surrendering it?

Yes, many LIC policies allow you to take a loan against the surrender value, which can be a preferable option to surrendering the policy outright.

How can I surrender my LIC policy?

To surrender an LIC policy, you typically need to fill out a surrender request form, submit the policy document, and provide necessary identification and bank details. This can often be done at the LIC branch or online through the LIC portal.

What documents are required to surrender an LIC policy?

Required documents include the original policy bond, a surrender request form, a cancelled cheque or bank account details, and identification proof.

How long does it take to process a surrender request?

It usually takes 7-15 working days for LIC to process a surrender request and credit the surrender value to your bank account.

Do all LIC policies have a surrender value?

Not all LIC policies accrue surrender value. Typically, policies like endowment plans, money-back policies, and whole life policies have surrender values, while term insurance policies usually do not.

What is the surrender value for a money-back policy?

For a money-back policy, the surrender value is calculated based on the premiums paid, excluding the survival benefits already paid, and any accrued bonuses.

How does the surrender value differ between traditional and ULIP policies?

For traditional policies, the surrender value includes the basic sum assured and bonuses. For ULIPs, the surrender value is the fund value minus applicable charges, reflecting the investment performance.

Leave a Reply