In the evolving landscape of digital banking, State Bank of India (SBI) continues to lead with innovative solutions tailored to modern financial needs. One such offering is the SBI Fexipay scheme, which bridges the gap between traditional savings accounts and fixed deposits, allowing customers to enjoy the benefits of both. At the heart of this product is the SBI Fexipay interest rate, which determines the returns on investments made under this scheme.

This comprehensive guide delves into the SBI Fexipay interest rate, providing a detailed analysis of its structure, benefits, calculation, and comparison with other similar products. We will explore the nuances of how interest rates impact the returns on Fexipay, the factors influencing these rates, and practical steps for maximizing your earnings. We designed this article for a diverse audience, ranging from seasoned investors to individuals new to banking, to offer a thorough understanding of SBI Fexipay and its interest dynamics.

What is SBI Fexipay?

The State Bank of India offers the flexible deposit scheme SBI Fexipay, which combines the liquidity of a savings account with the higher interest rates of fixed deposits. This hybrid product allows customers to enjoy the best of both worlds – the ability to withdraw funds as needed while earning higher returns on the remaining balance.

Features of SBI Fexipay

- Flexibility: Allows partial withdrawals without breaking the entire deposit.

- Higher Interest Rates: Offers interest rates similar to fixed deposits.

- Liquidity: Provides easy access to funds like a savings account.

- Automated Transfers: Enables automatic transfer of surplus savings into Fexipay.

Benefits of SBI Fexipay

- Optimal Returns: Maximizes returns on idle funds.

- Convenience: Simplifies fund management with automated features.

- Financial Planning: Helps in better financial planning with flexible access to funds.

- Safety: Ensures the security of principal with the backing of SBI.

What is an Interest Rate?

An interest rate is the percentage of the principal amount that a lender charges for the use of its money. In the context of SBI Fexipay, it represents the returns that customers earn on their deposited funds.

Types of Interest Rates

- Fixed Interest Rate: Remains constant over the deposit tenure.

- Floating Interest Rate: Varies based on market conditions or benchmark rates.

- Compound Interest: Interest calculated on the initial principal and the accumulated interest from previous periods.

Importance of Interest Rates

Interest rates are crucial for:

- Investment Returns: Determining the profitability of investments.

- Economic Growth: Influencing consumer spending and saving behaviors.

- Inflation Control: Helping in managing inflation through monetary policies.

SBI Fexipay Interest Rate Structure

Interest Rate Determination

The SBI Fexipay interest rate is typically determined based on:

- Market Rates: Prevailing interest rates in the financial market.

- RBI Guidelines: Directions and policies set by the Reserve Bank of India.

- Bank’s Internal Policies: SBI’s financial strategies and policies.

Interest Rate Slabs

SBI Fexipay interest rates are often divided into slabs based on:

- Deposit Amount: Larger deposits may attract higher interest rates.

- Tenure: Longer deposit tenures usually offer higher rates.

- Customer Type: Rates may vary for different customer segments (e.g., senior citizens, regular customers).

Current Interest Rates

The current interest rates for SBI Fexipay can be found on the official SBI website or by contacting the nearest SBI branch. These rates are subject to change based on economic conditions and bank policies.

How SBI Fexipay Interest is Calculated

Basic Formula

The interest on SBI Fexipay is generally calculated using the formula:

![]()

Where:

- Principal is the initial amount deposited.

- Rate is the annual interest rate.

- Time is the tenure of the deposit in years.

Compound Interest Calculation

For compounded interest, the formula is:

![]()

Where:

- A is the amount after time t.

- P is the principal.

- r is the annual interest rate.

- n is the number of times interest is compounded per year.

- t is the time in years.

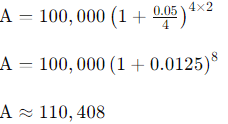

Practical Example

Assume a deposit of ₹100,000 at an annual interest rate of 5% compounded quarterly for 2 years. The calculation would be:

The interest earned would be:

Interest = 110,408 − 100,000 = 10,408

Factors Influencing SBI Fexipay Interest Rates

Economic Conditions

- Inflation: Higher inflation typically leads to higher interest rates.

- Economic Growth: A growing economy may offer higher interest rates to encourage savings.

- Monetary Policy: Decisions by the Reserve Bank of India on interest rates.

Bank Policies

- Asset-Liability Management: How SBI manages its assets and liabilities can influence interest rates.

- Profit Margins: SBI’s target profit margins may affect the rates offered on deposits.

Competition

- Market Competition: Interest rates offered by other banks can impact SBI’s rates.

- Customer Demand: Demand for Fexipay and similar products influences rate decisions.

Global Economic Trends

- Global Interest Rates: International trends can affect local interest rates.

- Foreign Investments: Influx or outflow of foreign investments can influence rates.

Benefits of SBI Fexipay Interest Rates

Higher Returns

SBI Fexipay interest rates are generally higher than regular savings accounts, offering better returns on surplus funds.

Flexible Access

The flexibility to withdraw funds without penalty makes it an attractive option for those seeking liquidity with better returns.

Automated Savings

Automated transfer of excess funds into Fexipay ensures optimal utilization of idle funds without manual intervention.

Security

Being a product of SBI, Fexipay offers the security of funds backed by India’s largest public sector bank.

Comparing SBI Fexipay with Other Bank Products

SBI Fexipay vs. Fixed Deposits

- Interest Rates: Fixed deposits may offer slightly higher rates but lack liquidity.

- Flexibility: Fexipay provides more flexibility compared to fixed deposits.

SBI Fexipay vs. Recurring Deposits

- Interest Calculation: Recurring deposits have fixed contributions, whereas Fexipay allows flexible contributions.

- Withdrawal Options: Fexipay allows partial withdrawals without breaking the entire deposit.

SBI Fexipay vs. Savings Accounts

- Interest Rates: Fexipay offers higher interest rates compared to regular savings accounts.

- Liquidity: Both provide easy access to funds, but Fexipay offers better returns.

SBI Fexipay vs. Mutual Funds

- Risk: Mutual funds carry higher risks compared to the low-risk Fexipay.

- Returns: Mutual funds may offer higher returns but with greater volatility.

Practical Steps for Maximizing SBI Fexipay Interest

Regular Contributions

Regularly transfer surplus funds into SBI Fexipay to maximize interest earnings.

Monitoring Rates

Keep an eye on interest rate changes and adjust contributions accordingly to take advantage of higher rates.

Utilize Automated Features

Set up automated transfers from your savings account to Fexipay to ensure continuous optimal use of funds.

Compare Products

Periodically compare Fexipay with other investment options to ensure you are getting the best returns.

How to Open an SBI Fexipay Account

Eligibility Criteria

- Individuals: Indian residents and NRIs.

- Entities: Firms, companies, and organizations can also open Fexipay accounts.

Required Documents

- Identification Proof: Aadhaar card, PAN card, passport, etc.

- Address Proof: Utility bills, bank statements, etc.

- Account Details: Existing SBI account details for linking.

Application Process

- Step 1: Visit the nearest SBI branch or use online banking.

- Step 2: Fill out the application form and submit the required documents.

- Step 3: Link your savings account for automated transfers.

- Step 4: Complete the KYC verification process.

- Step 5: Start transferring funds to your Fexipay account.

Online Application

SBI’s internet banking and mobile apps provide convenient options for opening and managing an SBI Fexipay account online. Customers can apply through these platforms by following a few simple steps.

Account Activation

Once your application is approved and the account is opened:

- You will receive confirmation from SBI.

- Funds can be transferred into the Fexipay account immediately for earning interest.

Customer Support and Assistance

Contact Channels

- Customer Care: Reach out to SBI’s customer care for assistance with Fexipay-related queries.

- Branch Visits: Visit your nearest SBI branch for personalized assistance and support.

- Online Helpdesk: Utilize SBI’s online helpdesk for FAQs and troubleshooting.

Grievance Redressal

If you encounter issues with your Fexipay account:

- Step 1: Contact customer care for immediate resolution.

- Step 2: If unresolved, escalate to the branch manager or designated grievance redressal officer.

- Step 3: Seek assistance from the Banking Ombudsman if necessary.

Feedback Mechanism

Provide feedback to SBI on your experience with Fexipay through their feedback channels to help improve service delivery.

Regulatory Compliance and Security

RBI Guidelines

SBI Fexipay complies with RBI guidelines on interest rates, customer protection, and financial stability.

Security Measures

- Encryption: Transactions and data are encrypted to protect customer information.

- Authentication: Secure login processes and multi-factor authentication for transactions.

- Regular Audits: Continuous audits ensure compliance with security standards.

Legal Framework

SBI operates Fexipay within the legal framework established by Indian banking laws and regulations.

Future Outlook and Innovations

Technological Advancements

Future developments may include:

- Enhanced Mobile Banking: More features for managing Fexipay accounts on mobile devices.

- AI Integration: AI-driven insights for optimizing savings and maximizing returns.

- Blockchain Technology: Potential applications for secure transactions and data management.

Market Adaptation

SBI will continue to adapt Fexipay to meet evolving customer needs and preferences in the digital banking landscape.

Economic Trends

Adjustments in interest rates and offerings based on economic trends and customer demands will shape the future of Fexipay.

Conclusion

SBI Fexipay interest rates are designed to offer customers competitive returns with flexibility and ease of access. This guide has provided a comprehensive overview of how these interest rates are structured, calculated, and influenced by various factors. By understanding these dynamics, customers can make informed decisions about their investments and maximize their earnings through SBI Fexipay. Whether you are new to banking or an experienced investor, SBI Fexipay presents a valuable opportunity to grow your savings effectively within a trusted banking environment.

For the latest updates on SBI Fexipay interest rates and offerings, visit the official State Bank of India website or contact your nearest SBI branch. Always consult with financial advisors for personalized advice based on your financial goals and risk appetite.

SBI Fexipay Interest Rate Frequently Asked Questions (FAQs)

What is SBI Fexipay?

SBI Fexipay is a flexible deposit scheme offered by State Bank of India (SBI) that combines the benefits of savings accounts with higher interest rates similar to fixed deposits. It allows customers to earn competitive returns on their surplus funds while maintaining liquidity.

How are SBI Fexipay interest rate determined?

SBI Fexipay interest rates are influenced by various factors such as market conditions, Reserve Bank of India (RBI) guidelines, and SBI’s internal policies. These rates may vary based on the deposit amount, tenure, and customer category (e.g., regular customers, senior citizens).

What are the benefits of investing in SBI Fexipay?

- Higher Returns: Earns higher interest rates compared to regular savings accounts.

- Flexibility: Allows partial withdrawals without affecting the entire deposit.

- Liquidity: Provides easy access to funds when needed.

- Automated Savings: Automatically transfers surplus funds from savings accounts to maximize returns.

How is interest calculated on SBI Fexipay?

SBI typically calculates interest on Fexipay using compound interest formulas, where the principal amount, interest rate, and tenure determine the final amount earned. SBI may compound the interest quarterly or according to the chosen frequency.

Can I open an SBI Fexipay account online?

Yes, you can apply for and manage your SBI Fexipay account online through SBI’s internet banking portal or mobile app. Simply fill out the application form, submit the required documents, and link your savings account for automated transfers.

Are there any penalties for withdrawing funds from SBI Fexipay?

No, SBI Fexipay allows partial withdrawals without penalties. This feature ensures that you can access your funds as needed without losing out on the interest accrued on the remaining balance.

What happens if there is a change in SBI Fexipay interest rates?

Changes in SBI Fexipay interest rates may occur based on economic conditions and RBI directives. Customers will be informed of any rate changes through official communication channels. New rates will apply to future deposits or upon renewal of existing deposits.

How secure is SBI Fexipay?

SBI Fexipay operates under strict security measures, including encryption of transactions, secure login processes, and regular audits to ensure compliance with banking regulations and protect customer data.

Can NRIs (Non-Resident Indians) invest in SBI Fexipay?

Yes, both Indian residents and NRIs are eligible to open SBI Fexipay accounts, subject to providing the necessary identification and address proof documents as per RBI guidelines.

Where can I get more information about SBI Fexipay interest rates?

For the latest updates on SBI Fexipay interest rates, visit the official State Bank of India website or contact your nearest SBI branch. Customer service representatives can provide detailed information and assist with any queries related to Fexipay.

What are the different types of SBI Fexipay accounts available?

SBI Fexipay accounts are generally categorized based on deposit amounts, tenure, and customer types. Options may include regular Fexipay accounts for individual customers, senior citizen Fexipay accounts with preferential rates, and corporate Fexipay accounts for businesses and organizations.

How often are SBI Fexipay interest rates updated?

SBI Fexipay interest rates are subject to periodic updates based on prevailing market conditions, RBI guidelines, and SBI’s internal policies. SBI communicates changes in interest rates to customers through official channels and applies new rates to subsequent deposits or upon the renewal of existing deposits.

Are there any tax implications on interest earned from SBI Fexipay?

Yes, interest earned from SBI Fexipay is subject to income tax as per the prevailing tax laws in India. TDS (Tax Deducted at Source) may be applicable based on the interest earned and your tax status. Customers are advised to consult with tax advisors or financial planners for guidance on tax implications related to Fexipay earnings.

Can I convert my existing savings account balance into SBI Fexipay?

Yes, customers can transfer surplus funds from their existing savings accounts into SBI Fexipay to earn higher interest rates. This transfer can be done manually or set up through automated processes for convenience.

How does SBI Fexipay compare with other investment options like mutual funds or stocks?

SBI Fexipay offers a low-risk investment option with competitive interest rates and flexibility in fund accessibility. Compared to mutual funds or stocks, which carry higher market risks but may offer potentially higher returns, Fexipay appeals to investors seeking stable returns with minimal risk.

Can I withdraw my entire Fexipay deposit before maturity?

Yes, while SBI Fexipay allows partial withdrawals without penalties, withdrawing the entire deposit before maturity may result in forfeiting the accrued interest. It’s advisable to check with SBI regarding specific withdrawal policies and implications.

What should I do if I have a complaint or issue regarding my SBI Fexipay account?

Customers facing issues or having complaints related to their SBI Fexipay account can contact SBI’s customer care through various channels. Customer service representatives address initial grievances, and you can escalate unresolved concerns to branch managers or designated grievance redressal officers for further resolution.

Is there a minimum deposit requirement for opening an SBI Fexipay account?

Yes, SBI may have a minimum deposit requirement for opening a Fexipay account, which can vary based on the type of account and customer category. We recommend checking with SBI or visiting their official website for specific details on minimum deposit requirements.

Can I nominate someone for my SBI Fexipay account?

Yes, customers have the option to nominate a beneficiary for their SBI Fexipay account. You can fill out nomination forms during the account opening process or update them later according to your preference. Nomination ensures that in the event of the depositor’s demise, the nominated person receives the funds from the Fexipay account.

How can I track the performance of my SBI Fexipay account?

Customers can monitor the performance of their SBI Fexipay account through regular statements provided by SBI. Additionally, online banking platforms and mobile apps offer convenient access to account details, transaction history, and current interest earnings.

Leave a Reply